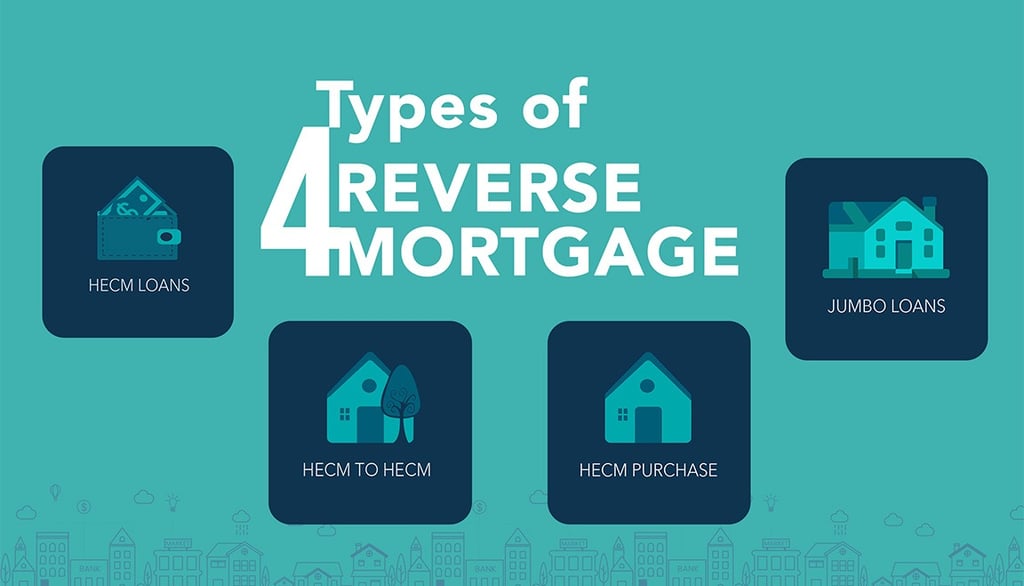

The 4 Types of Services for a Reverse Mortgage

Discover the four essential reverse mortgage services, from HECM Standard to Jumbo options, tailored for homeowners 62+ seeking financial flexibility.

CORE REVERSE MORTGAGE TERMS

Brian Bailey

9/2/20252 min read

Let’s start from the basics.

Hello, Arizona homeowners and advisors. The HECM Standard is a government-backed reverse mortgage for those 62+, allowing access to home equity via lump sum, line of credit, or monthly payments—without selling or monthly repayments beyond taxes and insurance. I've helped Phoenix clients use it for retirement enhancements or home renovations. It ensures ownership retention and FHA protection, where heirs aren't liable beyond fair market value. Interested in how this secures your future?

Benefits of HECM Standard Protections

Building on that, HECM Standard offers robust safeguards: FHA insurance covers lender defaults, mandatory HUD counseling protects borrowers, and proceeds are tax-free (consult a tax advisor for impacts on programs like Medicaid). A Tucson family I assisted preserved their estate this way. Equity tapping is secure, with MIPs at closing and ongoing. Explore more https://reversefinancial.com/reverse-mortgage-products. Let's discuss tailoring this to your needs.

Exploring HECM for Purchase

Next, the HECM for Purchase lets seniors 62+ buy a new primary residence with reverse mortgage funds and a down payment, avoiding traditional payments. Ideal for rightsizing, relocating near family, or boosting purchasing power without depleting savings. Eligible properties include single-family homes, FHA-approved condos, and more—no mobile homes or investments. I guided a Scottsdale client to their dream home seamlessly. Check https://reversefinancial.com/hecm-for-purchase-for-a-reverse-mortgage. Could this be your client’s next step?

How HECM for Purchase Works

In practice, HECM for Purchase requires a 45-62% down payment based on age and rates, with non-recourse protection ensuring no debt beyond home value. Funds come from personal savings or asset sales, and contracts must include FHA clauses without rent-backs. Occupancy certification is annual, plus obligations like taxes and maintenance. A Mesa buyer I supported enhanced their lifestyle affordably. Ready to evaluate qualifications?

Understanding HECM to HECM Refinance

For existing HECM holders, refinancing to a new HECM can lower rates, increase equity access, or add spouse protections. It requires a net benefit at least five times costs, possibly waiving counseling if within five years. I've run scenarios for Gilbert clients seeing value increases. This aligns with FHA guidelines for better terms. Learn about it https://reversefinancial.com/hecm-to-hecm-in-a-reverse-mortgage. What changes might benefit your client?

Insights into Jumbo and Proprietary Options

For high-value homes exceeding FHA limits, Jumbo and Proprietary reverse mortgages offer larger loan amounts, starting at age 55. These private loans provide flexibility but lack FHA insurance, potentially involving recourse risks depending on state laws. I’ve assisted a Phoenix client with a luxury property to fund renovations, emphasizing the need for a financial planner to protect assets. Explore this at https://reversefinancial.com/jumbo-and-proprietary. Shall we assess if this suits your estate?

Plan for the Long Term

Advisors, consider these services in broader planning. Factor in property upkeep, taxes, and estate impacts—HECMs reduce equity but offer protections. A Flagstaff client I advised set reserves for maintenance, integrating with retirement goals. Jumbo options suit high-value homes but lack federal backing, so consult planners. I'd be glad to help map a sustainable path.

Final Thoughts

These four services—HECM Standard, for Purchase, to HECM Refinance, and Jumbo/Proprietary—provide versatile tools for Arizona seniors. Jumbo allows higher limits for luxury properties, with flexible ages (55+) but potential recourse risks. I've witnessed Tucson families gain freedom through informed choices. Visit https://reversefinancial.com/reverse-mortgage-products . I'm here to guide with a smile—let's connect and customize for your client’s situation!

About Us

Reverse Financial, founded in 2016 is dedicated to empowering homeowners with clear reliable reverse mortgage education. Over the years, we’ve evolved into a trusted online resource, helping clients understand options, plan confidently, and make informed financial decisions tailored to retirement goals.

Patriot Pacific Financial Corp. dba ReverseFinancial.com

NMLS: LO 325344 | CORP 1921615

License: LO 0916110 | CORP BK-1051631

7137 E Rancho Vista Dr, Suite B05, Scottsdale, AZ 85251

Connect With Us

Contact Us

Equal Housing Opportunity

Language Options

Disclosures and License Information